SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant X.

x

Filed by a Party other than the Registrant .

o

Check the appropriate box:

X.

xPreliminary Proxy Statement.

oConfidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

oDefinitive Proxy Statement.

oDefinitive Additional Materials.

oSoliciting Material under Rule 14a-12

§ 240.14a-12

RING ENERGY, INC.

(Name of the Registrant as Specified In Itsin its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

xNo fee required.

oFee paid previously with preliminary materials.

oFee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

| | | | | | | | | | | | | | |

| The 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Ring Energy, Inc., a Nevada corporation (“Ring” or the “Company”), will be held on May 25, 2023, at 10:00 a.m., Central Time, in Ring’s offices, located at 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380.You will be asked to consider and to approve the following proposals: | |

ANNUAL MEETING OF STOCKHOLDERS

DATE: May 25, 2023

TIME: 10:00 a.m. Central Daylight Time

PLACE: 1725 Hughes Landing Blvd. Suite 900 The Woodlands, TX 77380

RECORD DATE FOR STOCKHOLDERS ENTITLED TO VOTE: March 28, 2023

|

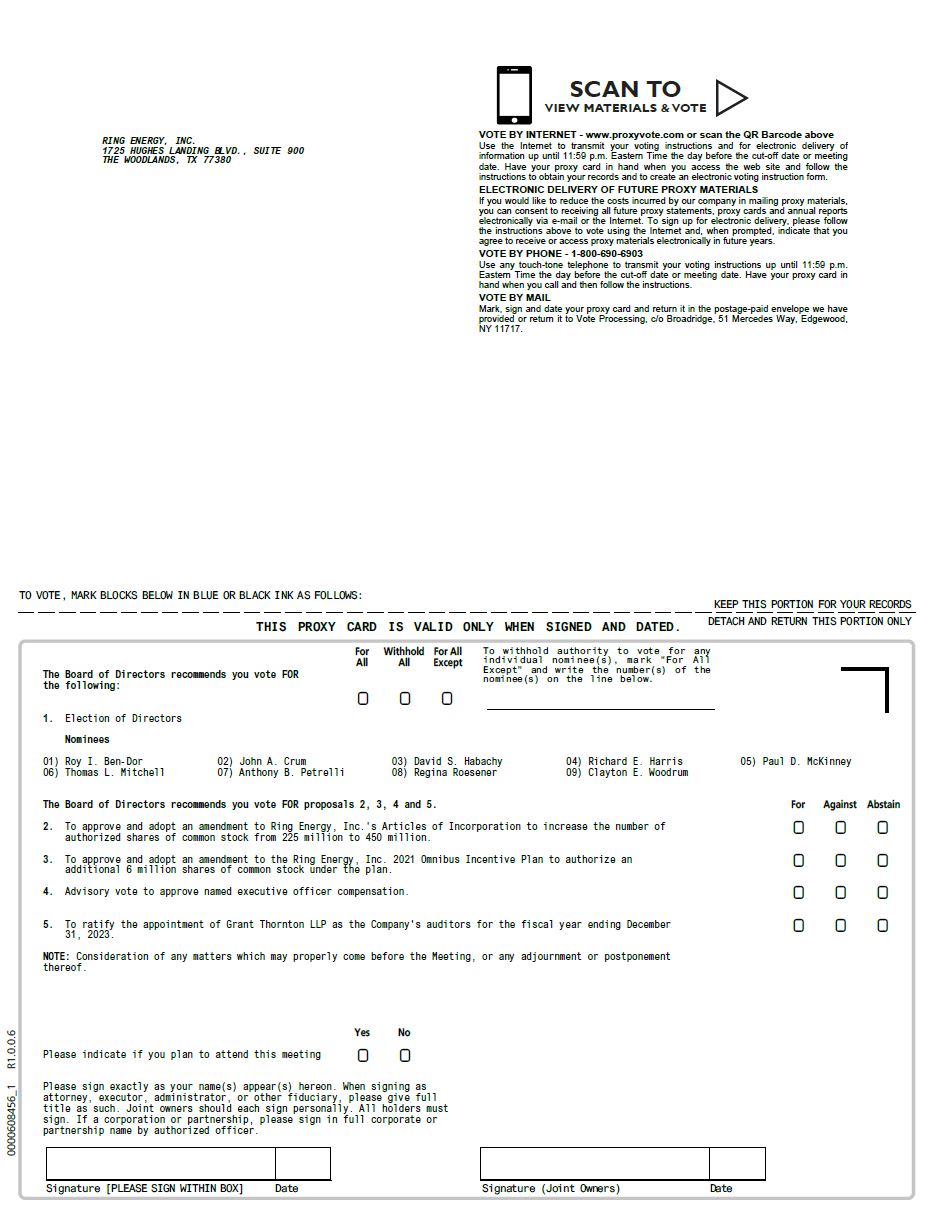

| 1 | Elect Nine Nominated Directors Included in the Proxy Statement to Serve on our Board | |

| 2 | Approve and Adopt an Amendment to our Articles of Incorporation to Increase the Authorized Shares of Common Stock from 225 million to 450 million | |

| 3 | Approve and Adopt an Amendment to the Ring Energy, Inc. 2021 Omnibus Incentive Plan to increase the shares available under the Plan by 6.0 million shares | |

| 4 | Approve on a Non-Binding, Advisory Basis, the Compensation of our Named Executive Officers | |

| 5 | Ratify the Appointment of Grant Thornton LLP as our Independent Registered Public Accounting Firm | |

| | |

Payment of Filing Fee (Check

This proxy statement and accompanying proxy card are being mailed to our stockholders on or about April 18, 2023. Our Annual Report on Form 10-K (the “Annual Report”) covering the appropriate box): |

| | |

X.

| No fee required.

|

| | |

.

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| | |

| (1)

| Title of each class of securities to which transaction applies:

|

| | |

| (2)

| Aggregate number of securities to which transaction applies:

|

| | |

| (3)

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing feeyear ended December 31, 2022 is calculated and state how it was determined):

|

| | |

| (4)

| Proposed maximum aggregate value of transaction:

|

| | |

| (5)

| Total fee paid:

|

| | |

| |

.

| Fee paid previously with preliminary materials.

|

| | |

.

| Check box ifenclosed, but does not form any part of the fee is offset as providedmaterials for solicitation of proxies.

The Notice of Annual Meeting and Proxy Statement herein provide further information on the Company’s performance and corporate governance and describe the matters to be presented at the Annual Meeting. Only stockholders of record at the close of business on March 28, 2023 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for examination at our offices during normal business hours for a period of ten calendar days prior to the Annual Meeting and will also be available during the Annual Meeting for inspection by Exchange Act Rule 0–11(a)(2)our stockholders. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, AND MAIL THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ACCOMPANYING ENVELOPE, OR VOTE YOUR SHARES USING THE TELEPHONE OR INTERNET VOTING INSTRUCTIONS PROVIDED. We thank you for your continued support and identifylook forward to seeing you at the filingAnnual Meeting.

By Order of the Board of Directors,

Travis T. Thomas Executive Vice President, Chief Financial Officer, Corporate Secretary & Treasurer

The Woodlands, Texas April [ ], 2023

| |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON May 25, 2023 The Notice of Annual Meeting, Proxy Statement, and Annual Report to Stockholders for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.year ended December 31, 2022, are available on Ring Energy, Inc.’s website at www.ringenergy.com. |

TABLE OF CONTENTS

| | | | | | | | |

| OVERVIEW | Joint Letter to Stockholders | 4 |

| Our Company – Mission & Vision | (1)

| Amount Previously Paid:

6 |

| Our Company – Strategic Priorities | | 7 |

| Questions and Answers About the 2023 Annual Meeting and Voting | (2)

| Form, Schedule or Registration Statement No.:

8 |

| Our 2022 Performance Highlights | | 14 |

| Our Commitment to Environmental, Social and Governance (“ESG”) | (3)

| Filing Party:

16 |

| Board Composition and Experience | | 18 |

| (4)

| Date Filed:

|

PROPOSAL 1: ELECTION OF DIRECTORS | Summary | 19 |

| Board Committees & Director Bios | 20 |

| Board Recommendation on Proposal | 25 |

|

| CORPORATE GOVERNANCE AND OUR BOARD | Corporate Governance Highlights | 26 |

| Our Board | 27 |

| Board Leadership Structure | 27 |

| Lead Independent Director | 27 |

| Annual Board Evaluation | 28 |

| Director Orientation and Continuing Education | 28 |

| Board Independence | 28 |

| Board Risk Assessment and Control | 29 |

| Insider Trading Policy | 29 |

| Board Committees | 30 |

| Director Nominations and Qualifications | 33 |

| Board of Directors Diversity | 33 |

| Communications With Our Board | 34 |

| | |

| EXECUTIVE OFFICERS | Executive Officer Bios | 35 |

| | |

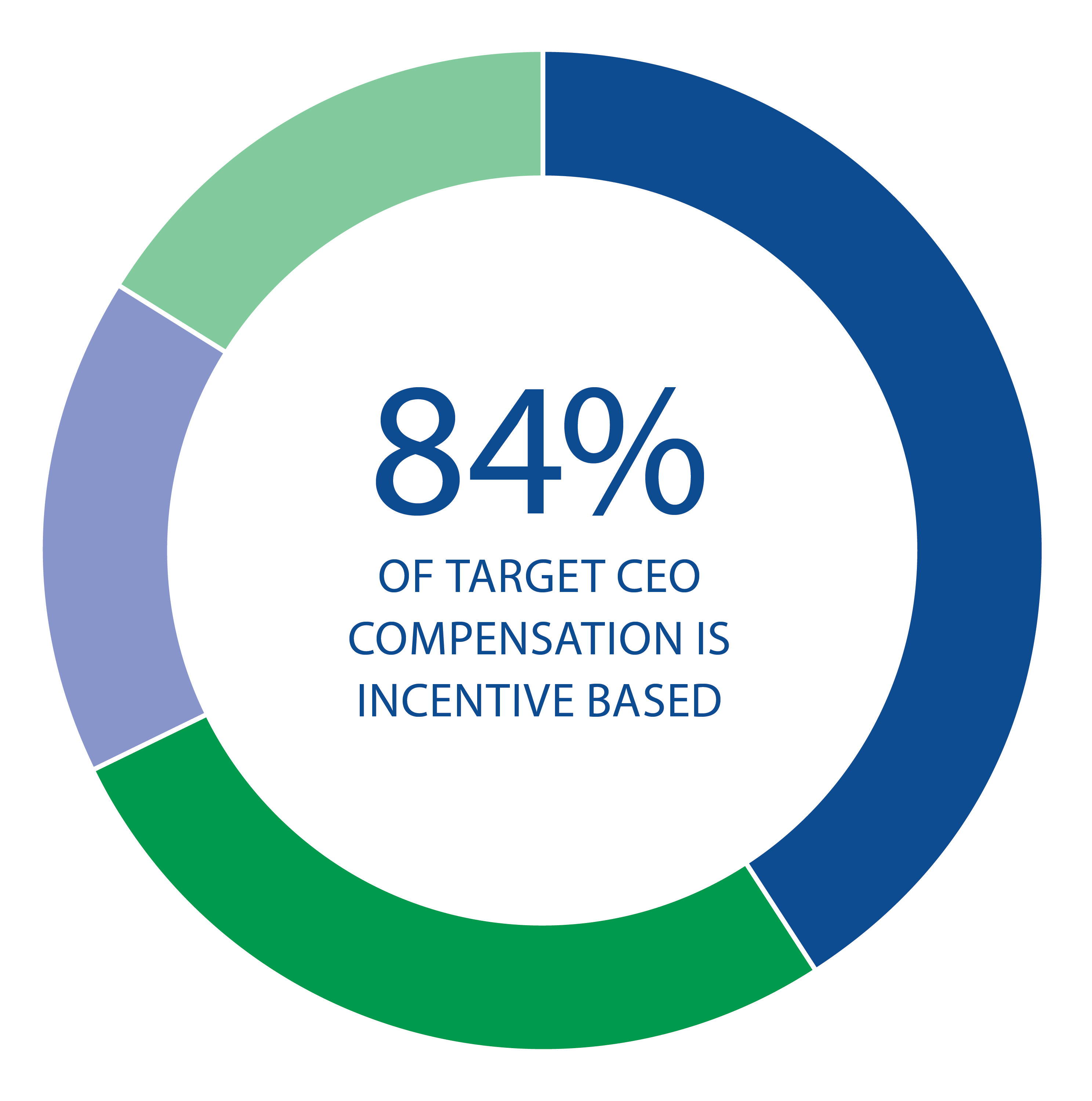

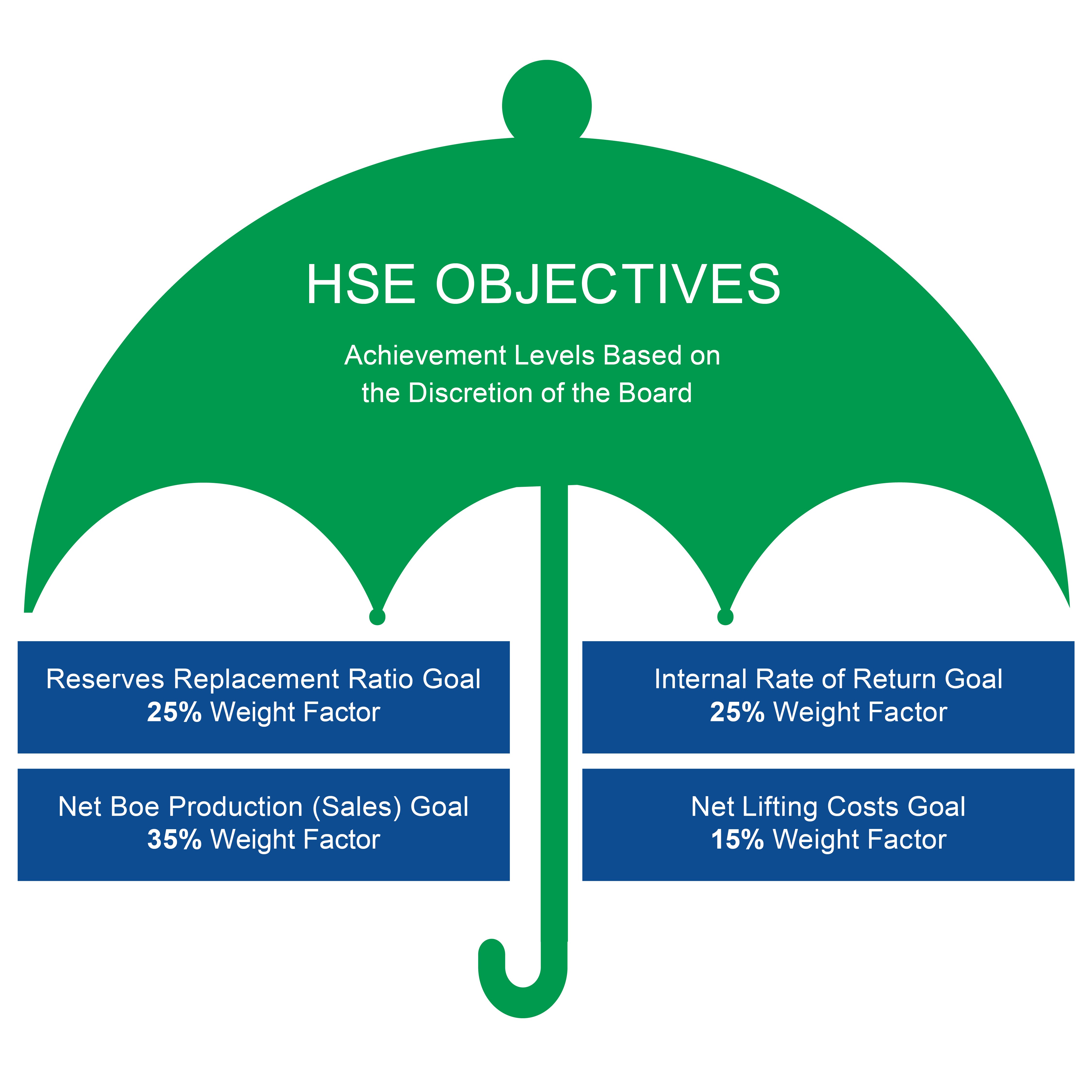

| COMPENSATION DISCUSSION & ANALYSIS | Summary | 37 |

| Overview of Executive Compensation | 38 |

| Additional Compensation Policy Highlights | 39 |

| Executive Compensation Philosophy | 39 |

| | |

| | | | | | | | |

| COMPENSATION DISCUSSION & ANALYSIS | Say-on-Pay and Stockholder Engagement | 40 |

| Executive Compensation Program Elements For 2022 | 40 |

| Management Stock Ownership Guidelines | 44 |

| Tax & Risk Considerations in Overall Program | 45 |

| EXECUTIVE COMPENSATION | Compensation of Named Executive Officers (2020-2022) | 47 |

| Employment Agreements | 49 |

| Grants of Plan-Based Awards | 51 |

| Outstanding Equity Awards at Fiscal Year-End | 52 |

| Option Exercises and Stock Vested | 53 |

| Pension Benefits and Nonqualified Deferred Compensation | 53 |

| Potential Payments Upon Termination or Change In Control | 54 |

| CEO Pay Ratio | 59 |

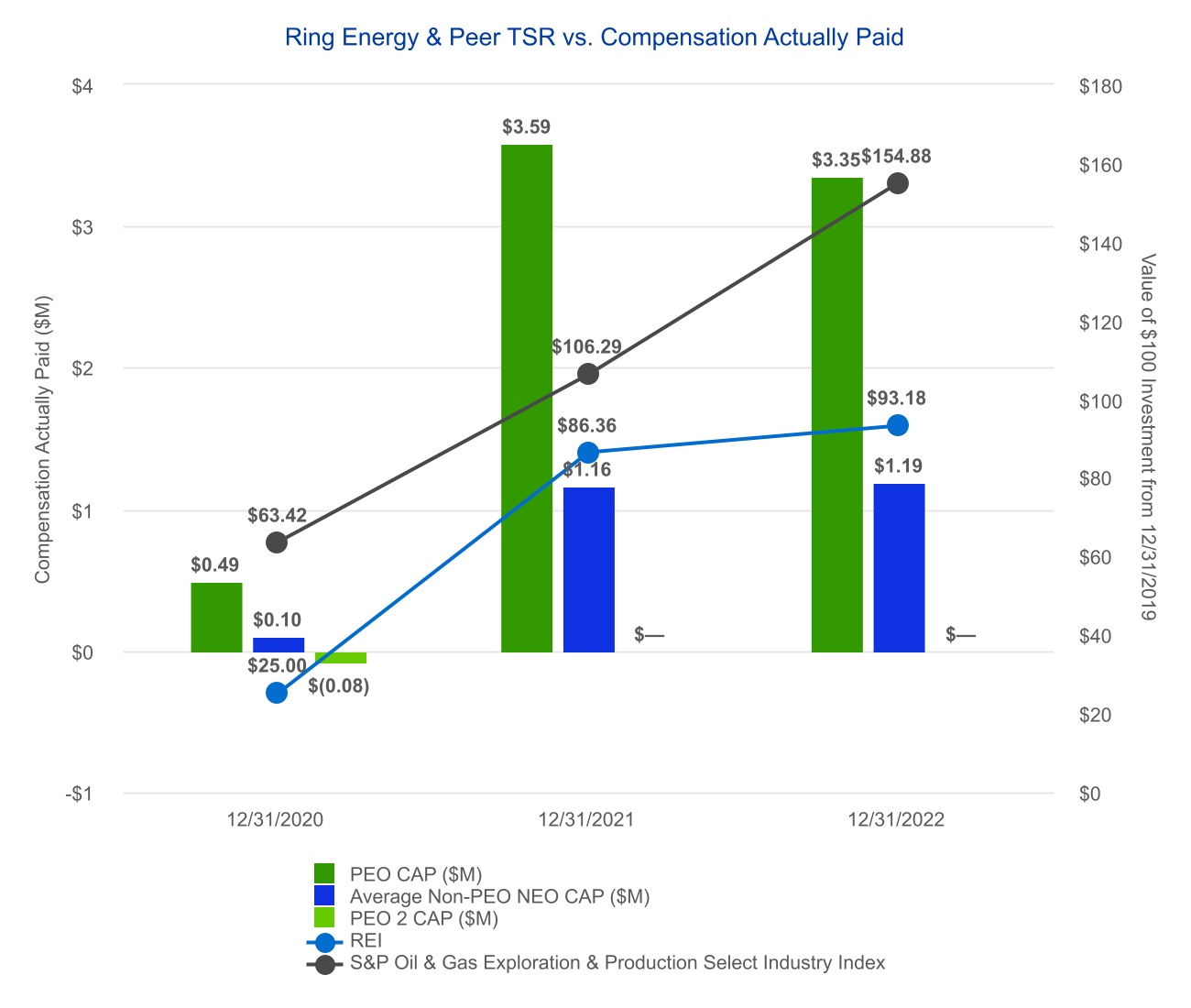

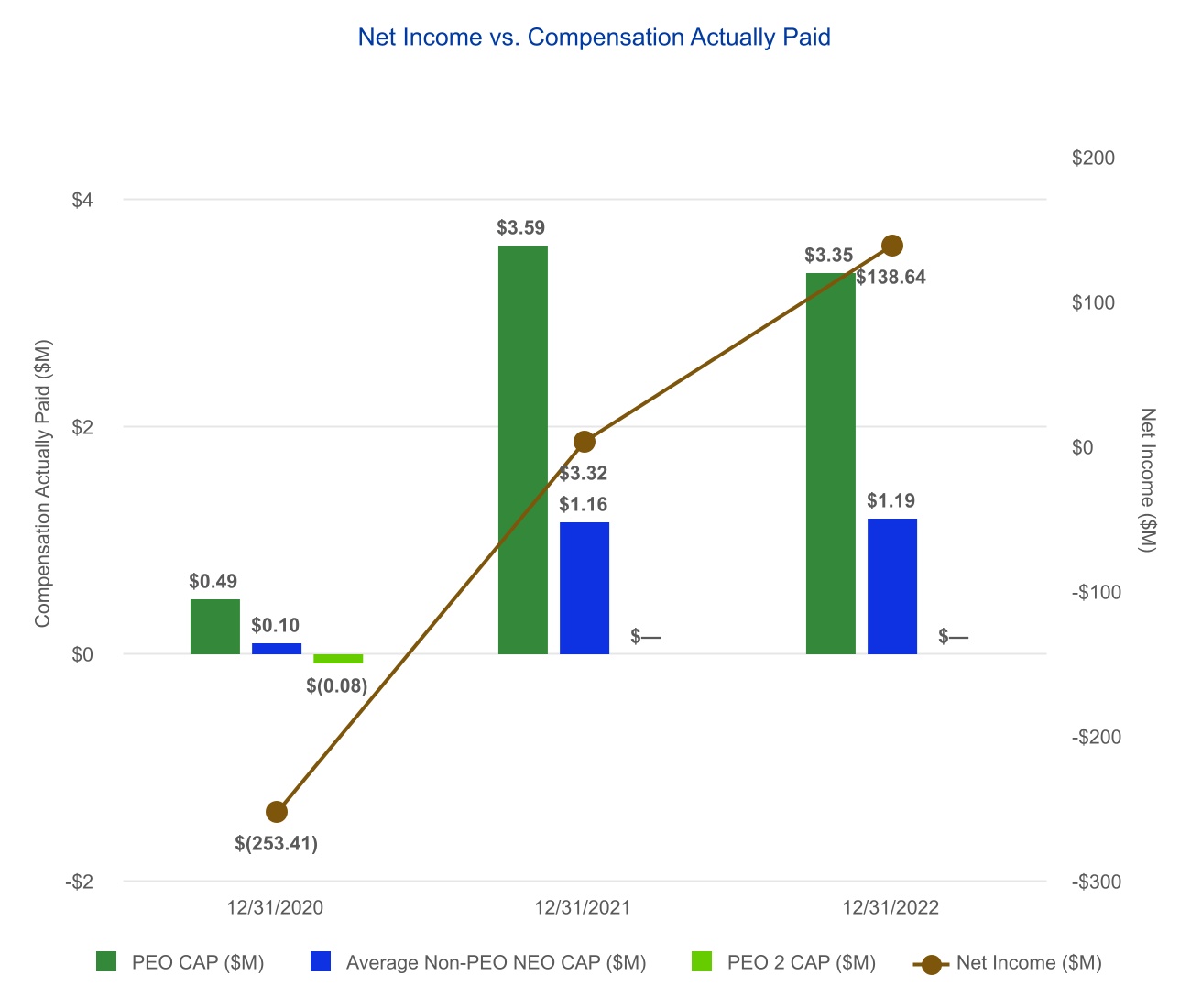

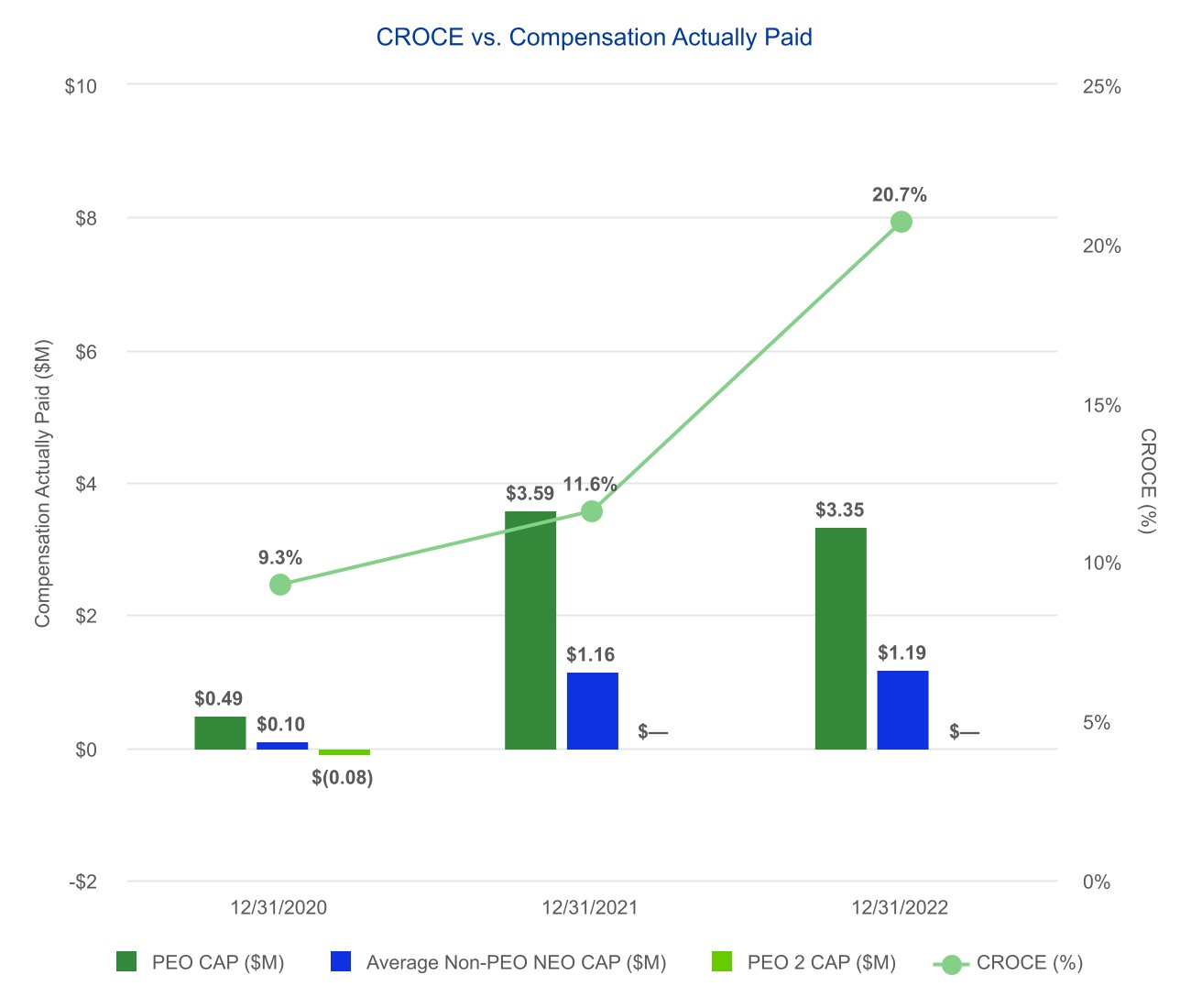

| Pay Versus Performance | 60 |

| DIRECTOR COMPENSATION | Director Compensation | 65 |

| OTHER COMPENSATION MATTERS | Compensation Committee Report | 68 |

| Compensation Committee Interlocks and Insider Participation | 68 |

| RELATED PARTY TRANSACTIONS | Transactions With Related Persons, Promoters and Certain Control Persons | 69 |

| BENEFICIAL OWNERSHIP | Security Ownership of Certain Beneficial Owners and Management & Other Matters | 71 |

|

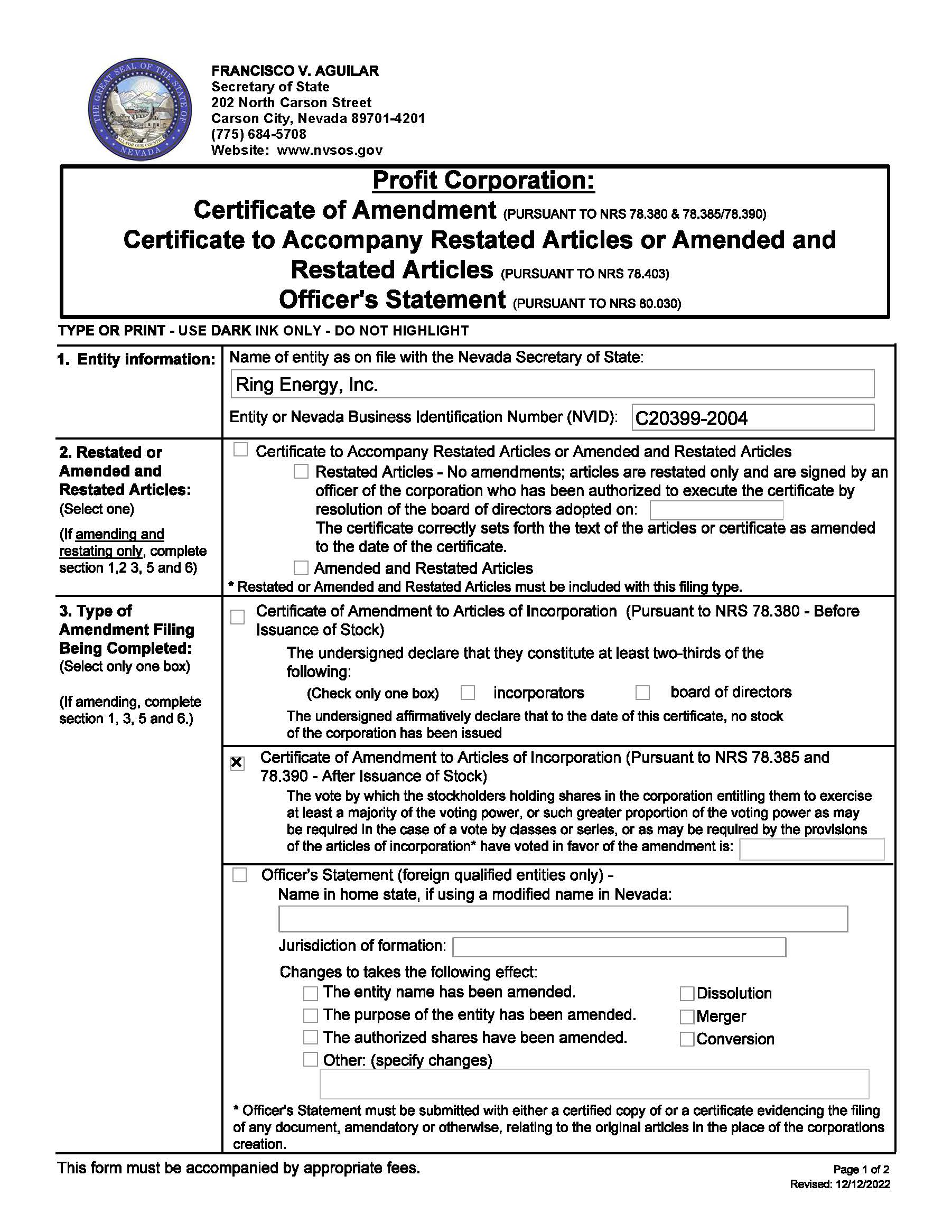

| PROPOSAL 2: INCREASE TO AUTHORIZED SHARES OF COMMON STOCK | Background | 74 |

| Text of the Proposed Amendment | 74 |

| Reasons for the Proposed Amendment | 74 |

| Possible Effects of the Proposed Amendment | 75 |

| Interests of Directors and Executive Officers | 75 |

| Vote Required | 75 |

| Board Recommendation on Proposal | 76 |

| | |

| PROPOSAL 3: AMENDMENT TO THE RING ENERGY, INC. 2021 OMNIBUS INCENTIVE PLAN TO INCREASE THE SHARES AVAILABLE UNDER THE PLAN BY 6.0 MILLION SHARES | Description and Text of the Proposed Plan Amendment | 77 |

| Summary of the 2021 Plan | 77 |

| Description of the Amended Plan | 78 |

| New Plan Benefits | 81 |

| Summary of Federal Income Tax Consequences | 82 |

| Importance of Consulting a Tax Adviser | 83 |

| Vote Required for Approval | 83 |

| Board Recommendation on Proposal | 83 |

| | |

PROPOSAL 4: NON-BINDING, ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | Summary | 84 |

| Board Recommendation on Proposal | 84 |

|

| PROPOSAL 5: RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP | Summary and Fees Detail | 85 |

| Board Recommendation on Proposal | 86 |

| Audit Committee Report | 87 |

|

| STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR THE 2024 ANNUAL MEETING AND OTHER ITEMS | Summary of Procedures For Submitting a Proposal or Nominating a Director | 89 |

| Other Business | 80 |

| Annual Report | 80 |

| Appendix A: GAAP to Non-GAAP Reconciliations | 91 |

| Appendix B: Certificate of Amendment | 93 |

| Appendix C: Amendment No. 1 to the Ring Energy, Inc. 2021 Omnibus Incentive Plan | 96 |

RING ENERGY

INC.6555 South Lewis Street

Tulsa, OK 74136

(918) 499-3880

NOTICE OF SOLICITATION OF CONSENTS

January __, 2013

TO OUR SHAREHOLDERS:

This Notice

DEAR FELLOW STOCKHOLDERS,

On behalf of Solicitationthe Board of Consents and accompanying Consent Solicitation Statement are furnished to you byDirectors of Ring Energy, Inc., we are pleased to

invite you to our 2023 Annual Meeting of Stockholders, which will take place on May 25, 2023 at 10:00 a.m. Central Daylight Time in our offices located at 1725 Hughes Landing Blvd., Suite 900, The Woodlands, Texas 77380.

2022 was a Nevada corporationtransformational year for Ring Energy. Our operational and financial performance was driven by a number of factors, the most significant being the Company's acquisition of Stronghold Energy's assets that we announced in early July and closed on August 31, 2022 (the “Company” or “us” or “we” or “our”"Stronghold Transaction"). The immediately accretive acquisition of these complementary Central Basin assets in connectionthe Permian Basin substantially increased our size and scale, lowered our overall cost structure, and materially increased the inventory and capital efficiency of our low cost, high rate-of-return investment opportunities. The result has been increased free cash flow generation that we are using to pay down debt at a faster rate than we could have done on a standalone basis. The Stronghold Transaction also materially improved our financial position. We ended 2022 with approximately $188 million of liquidity — more than $125 million higher than year-end 2021. In addition, we substantially reduced our leverage ratio from 3.5 times at year-end 2021 to 1.6 times as of December 31, 2022. Our enhanced flexibility and improved capital efficiency are critical as we continue to execute our value driven strategy.

During full year 2022, we also benefited from the execution of a continuous development program, including the drilling and completion of 27 horizontal wells and five vertical wells, as well as the recompletion of 12 wells. Complementing our internal expansion efforts was our ongoing focus on reducing the cost structure of our business on a per barrel basis.

The combined result of our targeted initiatives for 2022 was record setting levels of production, net income, adjusted net income, adjusted EBITDA and cash flow from operations. Our success in 2022 was also reflected in our year end SEC proved reserves that grew 78% over the prior year end to a record 138.1 million barrels of oil equivalent. Of course, none of our success in 2022 would have been possible without our talented workforce and business partners, and we want to thank everyone for their hard work and dedication.

During the past year, we also continued to make important progress on our ESG initiatives. We encourage readers to review our latest Sustainability Report published in late 2022 that discusses our performance and improvement initiatives, and our plans to drive further alignment with the solicitationvarious ESG reporting frameworks over time.

Our efforts in 2023 remain squarely focused on further debt reduction and strengthening of our balance sheet. In support of this focus, we will continue to invest in the development of our high rate-of-return inventory to maintain or slightly grow our production and drive further operational efficiencies in the business. We will also continue to evaluate and pursue opportunities to increase stockholder value through accretive, balance sheet enhancing acquisitions. We believe our value focused, proven strategy retains the discipline and flexibility necessary to manage the risks associated with ongoing price volatility and should position the Company to return capital to our stockholders in the future.

On behalf of Ring’s Board of Directors, executive management and employee team, we want to thank all of our board of directors of written consents fromstockholders for their continued support. Your vote is very important to us, and we encourage you to review the holdersenclosed proxy statement and to promptly vote so your shares are represented at the Annual Meeting.

Best regards,

Paul D. McKinney

Chairman of the Company’s Common StockBoard of Directors & Chief Executive Officer

Anthony B. Petrelli

Lead Independent Director

OUR COMPANY

Ring Energy, Inc. is a growth oriented independent energy company engaged in oil and natural gas development, production, acquisition and exploration of high-quality, oil and liquids rich assets in the Permian Basin.

OUR MISSION & VISION

Ring’s mission is to

take action withoutdeliver competitive and sustainable returns to its stockholders by developing, acquiring, exploring for, and commercializing oil and natural gas resources vital to the world’s health and welfare. Successfully achieving Ring’s mission requires a

shareholders’ meeting.

Our boardfirm commitment to operating safely in a socially responsible and environmentally friendly manner, while ensuring the Company conducts its business with honesty and integrity.

The key principles supporting Ring’s strategic vision are:

■Ensuring health, safety, and environmental excellence and a strong commitment to our employees and the communities in which we work and operate;

■Continuing to generate free cash flow to improve and build a sustainable financial foundation;

■Pursuing rigorous capital discipline focused on our highest returning opportunities;

■Improving margins and driving value by continuously targeting additional operating cost reductions and capital efficiencies; and

■Strengthening the balance sheet by steadily paying down debt, divesting of directorsnon-core assets and becoming a peer leader in Debt/EBITDA metrics.

OUR STRATEGIC PRIORITIES

Ring has historically capitalized on its low-risk, high-return asset base that is requestingfocused on the holdersconventional San Andres reservoir in the Permian Basin, which is one of the Company’s Common Stockmost prolific hydrocarbon producing regions in the U.S. As compared to consentunconventional plays, the San Andres offers much lower initial year and subsequent decline rates for production, which helps generate high rates of return and low breakeven economics.

The collective efforts of your management team are focused on creating stockholder value with Ring’s proven strategy. We are targeting a number of strategic initiatives that we believe will uniquely position Ring for continued operating and financial success, thereby enhancing long-term value for our stockholders.

To accomplish these goals, we are committed to

pursuing the following

proposals:

1.

To amendstrategic priorities:

| | | | | | | | | | | | | | |

| | | | |

Attract and retain high-quality people because achieving our mission will only be possible through our employees. It is critical to have compensation, development, and human resource programs that attract, retain and motivate the types of people we need to succeed. |

Pursue operational excellence with a sense of urgency, as we plan to deliver low cost, consistent, timely and efficient execution of our drilling campaigns, work programs and operations. This includes executing our operations in a safe and environmentally responsible manner, focusing on reducing our emissions, applying advanced technologies, and continuously seeking ways to reduce our operating cash costs on a per barrel basis. This objective is a foundational aspect of our culture and future success. |

Invest in risk-adjusted high rate-of-return projects. This will allow us to profitably grow our production and reserve levels and maximize free cash flow generation. |

Focus on generating free cash flow and strengthening our balance sheet by reducing debt through the use of excess cash from operations and potentially through proceeds from the sale of non-core assets. We believe remaining focused and disciplined in this regard will lead to meaningful returns for our stockholders and provide additional financial flexibility to manage potential future swings in the business cycle. |

Pursue strategic acquisitions that maintain or reduce our break-even costs, as well as improve our margins and operating costs. Financial strategies associated with these efforts will focus on delivering competitive debt-adjusted per share returns. This objective is key to delivering competitive returns to our stockholders on a sustainable basis. |

QUESTIONS AND ANSWERS ABOUT

THE 2023 ANNUAL MEETING AND VOTING

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the

Company’sAnnual Meeting, our stockholders will act upon the matters outlined in the Notice, including (1) the election of nine directors named in this proxy statement to our Board, each for a term ending on the date of the 2024 annual meeting of stockholders or until their successors are duly elected and qualified (this proposal is referred to as the “Election of Directors”); (2) the approval and adoption of an amendment (the "Charter Amendment") to our Articles of Incorporation

(as amended to date, the "Articles of Incorporation") to increase the authorized shares of Common Stock from 225 million to 450 million (this proposal is referred to as

set forth in the

Certificate"Authorized Share Proposal"); (3) the approval and adoption of

Amendment attached asAppendix Aan amendment to

the accompanying Consent Solicitation Statement (the “Articles Amendment”).

2.

To approve the Ring Energy, Inc. Long Term2021 Omnibus Incentive Plan to increase the shares available under the Plan by 6.0 million shares (this proposal is referred to as attachedthe "Plan Amendment Proposal"); (4) a non-binding, advisory vote to approve named executive officer compensation (this proposal is referred to asAppendix B “Advisory Vote on Executive Compensation”); (5) the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (this proposal is referred to as the “Ratification of Grant Thornton”); and (6) the transaction of such other business as may arise that can properly be conducted at the Annual Meeting or any adjournment or postponement thereof. Additionally, management will report on our performance during the last fiscal year and respond to questions from our stockholders.

WHAT IS A PROXY?

A proxy is another person that you legally designate to vote your stock. If you designate a person or entity as your proxy in a written document, such document is also called a proxy or a proxy card. All duly executed proxies received prior to the

accompanying Consent Solicitation Statement (the “Plan Approval”).

3.

To amendAnnual Meeting will be voted in accordance with the Ring Energy, Inc. Long Term Incentive Plan as set forthchoices specified thereon and, in connection with any other business that may properly come before the Annual Meeting, in the Amendmentdiscretion of the persons named in the proxy.

WHAT IS A PROXY STATEMENT?

A proxy statement is a document that regulations of the United States Securities and Exchange Commission (the “SEC”) require that we make available to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting. This proxy statement describes matters on which we would like you, as a stockholder, to vote and provides you with information on such matters so that you can make an informed decision.

WHAT IS “HOUSEHOLDING”?

One copy of the Notice, this proxy statement, and the Annual Report (collectively, the “Proxy Materials”) will be sent to stockholders who share an address, unless they have notified us that they want to continue receiving multiple packages. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs. If you received a householded mailing this year and you would like to have additional copies of the Proxy Materials mailed to you or you would like to opt out of this practice for future mailings, we will promptly deliver such additional copies to you if you submit your request in writing to Ring Energy, Inc. Long Term Incentive Plan attached, Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, or by telephone by calling (281) 397-3699. You may also contact us in the same manner if you received multiple copies of the Proxy Materials and would prefer to receive a single copy in the future. The Proxy Materials are also available on our website: www.ringenergy.com.

WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE SET OF VOTING MATERIALS?

Despite our efforts related to householding, you may receive more than one set of Proxy Materials, including multiple copies of the proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a proxy card and a voting instruction card. Please complete, sign, date, and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted at the Annual Meeting. You can also vote your shares over the phone or Internet. Please see “HOW DO I VOTE MY SHARES?” below for more information.

WHO IS ENTITLED TO NOTICE OF THE ANNUAL MEETING?

Governing laws as

Appendix C well as our governance documents require our Board to

establish a record date in order to determine who is entitled to receive notice of, attend, and vote at the

accompanying Consent Solicitation Statement (the “Plan Amendment”).

We have establishedAnnual Meeting, and any continuations, adjournments, or postponements thereof.

The record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on January 2, 2013, asMarch 28, 2023 (the “Record Date”).

As of the

Record Date, we had 180,627,484 shares of Common Stock outstanding. A list of all stockholders of record

date for determining shareholders entitled to

submit written consents.

We request that each shareholder complete, datevote at our Annual Meeting is on file at our principal office located at 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, and signwill be available for inspection at the enclosed written consent form and promptly return itAnnual Meeting.

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Subject to the Company’slimitations set forth below, stockholders at the close of business on the Record Date may vote at the Annual Meeting. If you are a beneficial owner of shares of Common Stock, you must have a legal counsel by mailproxy from the stockholder of record to vote your shares at 1656 Reunion Avenue, Suite 250, South Jordan, Utah 84095, by emailthe Annual Meeting.

WHAT IS A QUORUM?

A quorum is the presence at jamie@vancelaw.us,the Annual Meeting, in person or by faxproxy, of the holders of at (801) 446-8803. To be counted, your properly completed written consentleast one-third of the shares of our Common Stock outstanding and entitled to vote as of the Record Date. There must be a quorum for the Annual Meeting to be held. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is reached. Proxies received before 5:00 p.m. Mountain Time,but marked as abstentions or broker non-votes will be included in the calculation of votes considered to be present at the Annual Meeting.

WHAT ARE THE VOTING RIGHTS OF OUR STOCKHOLDERS?

Each holder of Common Stock is entitled to one vote per share of Common Stock on January __, 2013, subjectall matters to extension bybe acted upon at the Annual Meeting. Neither our boardArticles of directorsIncorporation, nor our Bylaws (as amended, the “Bylaws”), allow for cumulative voting rights in the election of directors.

WHAT IS THE DIFFERENCE BETWEEN A STOCKHOLDER OF RECORD AND A “STREET NAME” HOLDER?

Most stockholders hold their shares through a broker, bank, or

to early terminationother nominee rather than directly in their own name.

As summarized below, there are some distinctions between shares held of

solicitations if a majority approval is received.

Failure to returnrecord and those owned in street name.

■Stockholder of Record. If your shares are registered directly in your name with Standard Registrar and Transfer Company, Inc., our transfer agent, you are considered the enclosed written consent will have the same effect as a vote against the proposals. We recommend that all shareholders consent to the proposals, by marking the box entitled “FOR”stockholder of record with respect to those shares. As the proposalstockholder of record, you have the right to grant your voting proxy directly or to vote in person at the Annual Meeting.

■Street Name Stockholder. If your shares are held in a stock brokerage account or by a bank, fiduciary, or other nominee, you are considered the beneficial owner of shares held in “street name.” In this case, such broker, fiduciary, or other nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank, or nominee how to vote and are also invited to attend the Annual Meeting. If you hold your shares through a broker, bank, or other nominee, follow the voting directions provided by your broker, bank, or other nominee to vote your shares. Since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares.

HOW DO I VOTE MY SHARES?

Stockholders of Record: Stockholders of record may vote their shares or submit a proxy to have their shares voted by one of the following methods:

■By Written Proxy. You may indicate your vote by completing, signing, and dating your proxy card and returning it in the enclosed reply envelope.

■In Person. You may vote in person at the Annual Meeting by completing a ballot; however, attending the Annual Meeting without completing a ballot will not count as a vote.

■By Phone. Use any touch-tone telephone to call 1-800-690-6903 to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or the meeting date. Have your proxy card in hand when you call and then follow the instructions.

■By Internet. Use the Internet to access www.proxyvote.com to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or the meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

Street Name Stockholders: Street name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods:

■By Voting Instruction Card. If you hold your shares in street name, your broker, bank, or other nominee will explain how you can access a voting instruction card for you to use in directing the broker, bank, or other nominee how to vote your shares.

■In Person with a Proxy from the Record Holder. You may vote in person at the Annual Meeting if you obtain a legal proxy from your broker, bank, or other nominee. Please consult the instruction card or other information sent to you by your broker, bank, or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting.

If you are a stockholder of record, your shares will be voted by the management proxy holder in accordance with the instructions on the enclosed written consent form, and sendingproxy card you submit. For stockholders who have their shares voted by submitting a proxy, the written consent to us.management proxy holder will vote all shares represented by such valid proxies as our Board recommends, unless a stockholder appropriately specifies otherwise.

CAN I REVOKE MY PROXY OR CHANGE MY VOTE?

Yes. If you

sign and send in the written consent form but do not indicate howare a stockholder of record, you

want to vote as to the proposals,can revoke your

consent form will be treated as a consent “FOR” the proposal.

Consents may be revoked by shareholdersproxy at any time before it is voted at the Annual Meeting by doing one of the following:

■Submitting written notice of revocation stating that you would like to revoke your proxy to Ring Energy, Inc., Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380, which must be received prior to the Annual Meeting;

■Completing, signing, and dating another proxy card with new voting instructions and returning it by mail to Ring Energy, Inc., Attention: Travis T. Thomas, Corporate Secretary, Executive Vice President and Chief Financial Officer, 1725 Hughes Landing Blvd., Suite 900, The Woodlands, TX 77380 in time to be received, in which case the later submitted proxy will be recorded and earlier proxy revoked; or

■Attending the Annual Meeting, notifying the inspector of elections that weyou wish to revoke your proxy, and voting your shares in person at the Annual Meeting. Attendance at the Annual Meeting without submitting a ballot to vote your shares will not revoke or change your vote.

If you are a beneficial or street name stockholder, you should follow the directions provided by your broker, bank, or other nominee to revoke your voting instructions or otherwise change your vote before the applicable deadline. You may also vote in person at the Annual Meeting if you obtain a legal proxy from your broker, bank, or other nominee as described in “How do I vote my shares” above.

WHAT ARE ABSTENTIONS AND BROKER NON-VOTES?

An abstention occurs when the beneficial owner of shares, or a broker, bank, or other nominee holding shares for a beneficial owner, is present, in person or by proxy, and entitled to vote at a stockholder meeting, but fails to vote or voluntarily withholds its vote for any of the matters upon which the stockholders are voting.

If you are a beneficial owner and hold your shares in “street name,” you will receive instructions from your broker, bank, or other nominee describing how to vote your shares. If you do not instruct your broker or nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the NYSE American LLC (the “NYSE American”). There are non-discretionary matters for which brokers, banks, and acceptother nominees do not have discretionary authority to vote unless they receive timely instructions from you. If a broker, bank, or other nominee does not have discretion to vote on a particular matter and you have not given timely instructions on how the written consentbroker, banker, or other nominee should vote your shares, then the broker, bank, or other nominee indicates it does not have authority to vote such shares on its proxy and a “broker non-vote” results. Although any broker non-vote would be counted as present at the Annual Meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

If your shares are held in street name and you do not give voting instructions, the record holder will not be permitted to vote your shares with respect to Proposal 1 (Election of Directors), Proposal 2 (Charter Amendment), Proposal 3 (Plan Amendment), Proposal 4 (Advisory Vote on Executive Compensation), and your shares will be considered broker non-votes with respect to these proposals. If your shares are held in street name and you do not give voting instructions, the record holder will have discretionary authority to vote your shares with respect to Proposal 5 (Ratification of Grant Thornton).

WHAT VOTE IS REQUIRED FOR THE PROPOSALS TO BE APPROVED?

■Proposal 1 (Election of Directors): To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the votes cast by the holders of our Common Stock, present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. The director nominees who receive the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

■Proposal 2 (Charter Amendment): Approval of the Charter Amendment requires the affirmative vote of a majority of the outstanding voting power. Broker non-votes and abstentions will have the affect of a vote against this proposal.

■Proposal 3 (Plan Amendment): Approval of the Plan Amendment requires the affirmative vote of the holders of a majority of the outstanding sharesvotes cast by the holders of our Common Stock ofpresent in person or represented by proxy at the CompanyAnnual Meeting and entitled to vote.

By Order ofvote thereon. Broker non-votes and abstentions will not affect the Board of Directors

Denny Nestripke

Vice President

RING ENERGY, INC.

6555 South Lewis Street

Tulsa, OK 74136

(918) 499-3880

CONSENT SOLICITATION STATEMENT

General

This Consent Solicitation Statement is being furnished in connection with the solicitation of written consents of the shareholders of Ring Energy, Inc., a Nevada corporation (the “Company” or “us” or “we” or “our”) with regard to the following proposals:

1.

To amend the Company’s Articles of Incorporation as set forth in the Certificate of Amendment attached asAppendix A to the accompanying Consent Solicitation Statement (the “Articles Amendment”).

2.

To approve the Ring Energy, Inc. Long Term Incentive Plan as attached asAppendix B to the accompanying Consent Solicitation Statement (the “Plan Approval”).

3.

To amend the Ring Energy, Inc. Long Term Incentive Plan as set forth in the Amendment to Ring Energy, Inc. Long Term Incentive Plan attached asAppendix C to the accompanying Consent Solicitation Statement (the “Plan Amendment”).

This Consent Solicitation Statement contains important information for you to consider when deciding how to vote on these matters. Please read it carefully.

Our board of directors has approved the proposals and has chosen to seek to obtain shareholder approval of the proposals by written consent, rather than by calling a special meeting of shareholders, in order to eliminate the costs and management time involved in holding a special meeting, and in order to effect the proposed corporate action as quickly as possible. Written consents are being solicited from all of our shareholders pursuant to Section 78.320(2) of the Nevada Revised Statutes.

Voting materials, which include this Consent Solicitation Statement and a written consent form, are being mailed to all shareholders on or about January __, 2013. Our board of directors has set the close of business on January 2, 2013, as the record date for the determination of shareholders entitled to act with respect to the consent action (the “Record Date”). As of the Record Date, the Company had 14,166,011 shares of Common Stock outstanding of record, held by approximately 251 registered holders of record.

How to Submit Consents; Expiration Date

Shareholders of record who desire to consent to the proposals may do so by delivering the applicable written consent to us by hand, mail, email, facsimile or overnight courier, in accordance with the instructions contained in the written consent. If your shares are held in street name, voting will depend on the voting processes of your broker, bank, or other holder of record. Therefore, we recommend that you follow the voting instructions in the materials you receive directly from the holder of record.

If the written consent is properly completed and signed, the shareholder will be deemed to have consented to the proposals. Failure to return the enclosed written consent form will have the same effect as a vote against approval of the proposals.

Written consents by the shareholder(s) must be executed in exactly the same manner as the name(s) appear(s) on the stock certificates. If stock certificates to which a written consent relates are held of record by two or more joint holders, all such holders must sign the written consent. If a signature is by a trustee, executor, administrator, guardian, proxy, attorney-in-fact, officer of a corporation or other record holder acting in a fiduciary or representative capacity, such person should so indicate when signing and must submit proper evidence satisfactory to us of such person’s authority so to act. If stock certificates are registered in different names, separate written consents must be executed covering each form of registration.

FOR A WRITTEN CONSENT TO BE VALID, A SHAREHOLDER MUST COMPLETE, SIGN, DATE AND DELIVER THE WRITTEN CONSENT (OR PHOTOCOPY THEREOF) FOR SUCH HOLDER’S SHARES TO THE COMPANY’S LEGAL COUNSEL. SUCH WRITTEN CONSENT MAY BE DELIVERED TO THE COMPANY’S LEGAL COUNSEL BY HAND, MAIL, EMAIL, FACSIMILE OR OVERNIGHT COURIER.

All written consents that are properly completed, signed and delivered to our legal counsel before the Expiration Date (as defined below), subject to extension by our board of directors, and not revoked before our acceptance of the written consents, will be accepted.

The term “Expiration Date” means 5:00 p.m. Mountain Time, on January __, 2013, unless the Requisite Consents are received before such date, in which case this solicitation will expire on the date that such Requisite Consents are obtained, and such earlier date shall be the Expiration Date.

Final resultsoutcome of this solicitation of written consents will be published inproposal.

■Proposal 4 (Executive Compensation): To consider and vote upon, on a Form 8-K filed with the SEC after the Expiration Date.

Notwithstanding anything to the contrary set forth in this Consent Solicitation Statement, we reserve the right, at any time before the Expiration Date, to amend or terminate the solicitation, or to delay accepting written consents.

If you have any questions about the consent solicitation or how to vote or revoke your written consent, or if you should need additional copies of this Consent Solicitation Statement or voting materials, please contact Lloyd Tim Rochford,non-binding, advisory basis, a director of the Company, at (760) 346-5961.

Revocation of Consents

Written consents may be revoked or withdrawn by the shareholders at any time before 5:00 p.m. Mountain Time on the Expiration Date. To be effective, a written, facsimile, or email revocation or withdrawal of the written consent must be received by our legal counsel before such time and addressed as follows: Ring Energy, Inc., Attn: Legal Counsel, 1656 Reunion Avenue, Suite 250, South Jordan, Utah 84095; by email at jamie@vancelaw.us, or by facsimile at (801) 446-8803. A notice of revocation or withdrawal must specify the shareholder’s name and the number of shares being withdrawn. After the Expiration Date, all written consents previously executed and delivered and not revoked will become irrevocable.

Solicitation of Consents

Our board of directors is sending you this Consent Solicitation Statement in connection with its solicitation of consentsresolution to approve the Articles Amendment, Plan Approval, and Plan Amendment. Officers and directors of the Company holding approximately 34% of the voting control of the Company have indicated their intent to provide consents for approval of the items set forth herein. Certain directors, officers and employeescompensation of our Company may solicit written consents by mail, email, telephone, facsimile or in person. Our Company will pay for the costs of solicitation. We expect to pay the reasonable expenses of brokers, nominees and similar record holders in mailing voting materials to beneficial owners of our common stock.

PROPOSAL TO AMEND THE ARTICLES OF INCORPORATION

A copy of the Certificate of Amendment is attached asAppendix A to this Information Statement.

General

On December 27, 2012, the Board of Directors, by unanimous written consent, approved an amendment to the Articles of Incorporation of the Company increasing the total common shares authorized from 75,000,000 to 150,000,000, par value $.001 per share. An amendment to the Articles of Incorporation of the Company was also approved by the Board of Directors that authorized the issuance of 50,000,000 preferred shares, par value $.001 per share.

Further, the Board of Directors approved the Article numbered “TENTH” of the Articles of Incorporation to be amended in its entirety to read as follows:

The authority to adopt, amend or repeal bylaws is reserved exclusively to the Board of Directors.

Lastly, the Board of Directors approved the Article numbered “TWELFTH” of the Articles of Incorporation to be amended in its entirety to read as follows:

Except as otherwise provided by statute a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that:

a)

The director’s or officer’s act or failure to act constituted a breach of his or her fiduciary duties as a director or officer; and

b)

The breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

Purpose for Increase of Authorized Shares

The Board of Directors approved the Articles of Amendment to further the Company’s best interest to have additional authorized but unissued shares of common shares available in order to (a) provide flexibility for future corporate action; (b) raise additional capital by issuing additional shares of Common Stock or granting warrants for the future purchase of Common Stock; (c) grant additional options to purchase Common Stock to attract qualified employees and consultants; and (d) issue additional shares of common stock or securities convertible into Common Stock in connection with strategic corporate transactions, acquisitions, and other business arrangements and corporate purposes, as desirable to avoid repeated separate amendments to our Articles of Incorporation and the delay and expense incurred in amending the Articles of Incorporation. The Company intends to assess its need to issue securities for the corporate purposes described above and we believe that we need to be in a position to take advantage of opportunities when they arise or when we have a need. The Board of Directors believes that the currently available unissued shares do not provide sufficient flexibility for corporate action in the future.

Currently, there is no plan to issue any securities for the corporate purposes described above. In the event any securities are issued in the future, shareholders may suffer dilution to their ownership of the Company at the time of the issuance of the securities to the extent that assets of equal value as the fair market value of the shares being issued is not received. No additional corporate action is needed to issue any additional securities. The Company may even issue securities as a defensive mechanism in order to attempt to stop a hostile takeover by another company although there is no plan to do so at this time.

Purpose for Authorizing Preferred Shares

The Board of Directors approved the Articles Amendment to further the Company’s best interest to have authorized but unissued shares of preferred shares available in order to (a) provide flexibility for future corporate action; (b) further the Company’s best interest to have preferred shares in order to raise additional capital and to be used for corporate opportunities; and (c) issue shares of preferred stock or securities convertible into Common Stock in connection with strategic corporate transactions, acquisitions, and other business arrangements and corporate purposes, as desirable to avoid repeated separate amendments to our Articles of Incorporation and the delay and expense incurred in amending the Articles of Incorporation. The Company intends to assess its need to issue preferred shares for the corporate purposes described above and we believe that we need to be in a position to take advantage of opportunities when they arise or when we have a need. The Company currently has no preferred shares authorized in its Articles of Incorporation.

Currently, there is no plan to issue any preferred shares for the corporate purposes described above. In the event any preferred shares are issued in the future, shareholders may suffer dilution to their ownership of the Company at the time of the issuance of the preferred shares to the extent that assets of equal value as the fair market value of the shares being issued is not received. No additional corporate action is needed to issue any preferred shares. The Company may even issue preferred shares as a defensive mechanism in order to attempt to stop a hostile takeover by another company; there is no plan to do this at this time.

Purpose for Amendment to Tenth Article

As currently in effect the Tenth Article of the Company’s Articles of Incorporation reads as follows:

In furtherance and not in limitation of the powers conferred by the statute, the Board of Directors is expressly authorized:

a)

Subject to the By-Laws, if any, adopted by the Stockholders, to make, alter or amend the By-Laws of the corporation.

b)

To fix the amount to be reserved as working capital over and above its capital stock paid in; to authorize and to cause to be executed, mortgages and liens upon the real and personal property of this corporation.

c)

By resolution passed by a majority of the whole Board, to designate one (1) or more committees, each committee to consist of one or more of the Directors of the Corporation, which, to the extent provided in the resolution, or in the By-Laws of the corporation, shall have and may exercise the powers of the Board of Directors in the management of the business and affairs of the corporation. Such committee, or committees, shall have such name, or names as may be stated in the By-l.aws of the corporation, or as may be determined from time to time by resolution adopted by the Board of Directors.

d)

When and as authorized by the affirmative vote of the Stockholders holding stock entitling them to exercise at least a majority of the voting power given at a Stockholders meeting called form that purpose, or when authorized by the written consent of the holders of at least a majority of the voting stock issued and outstanding, the Board of Directors shall have power and authority at any meeting to sell, lease or exchange all of the property and assets of the corporation, including its good will and its corporate franchises, upon such terms and conditions as its Board of Directors deemed expedient and for the best interests of the corporation.

The purpose of the proposed amendment to the Tenth Article of the Articles of Incorporation of the Company is to indicate the Company’s desire, in conformity with statutory provisions, that the power to amend the Company’s Bylaws be reserved exclusively to the Board of Directors. By granting the Board of Directors exclusive authority to amend the Company’s Bylaws, the Company believes that the Bylaws will be more flexible in conforming to the continuing needs of a growing Company. The purpose of removing b), c), and d) from the Tenth Article is that the provisions either (i) are covered by statute or (ii) no longer apply to the Company.

Purpose for Amendment to Twelfth Article

As currently in effect the Twelfth Article of the Company’s Articles of Incorporation reads as follows:

No Director or Officer of the corporation shall be personally liable to the corporation or any of its stockholders for damages for breach of fiduciary duty as a Director or Officer involving any act or omission of any such Director or Officer; provided, however, that the foregoing provision shall not eliminate or limit the liability of a Director of Officer (i) for acts or omissions which involve intentional misconduct, fraud or a knowing violation of the law, or (ii) the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes. Any repeal or modification of this Article by the Stockholders of the corporation shall be prospective only, and shall not adversely affect any limitations on the personal liability of a Director of Officer of the corporation for acts or omissions prior to such repeal or modification.

The purpose of the proposed amendment to the Twelfth Article of the Articles of Incorporation of the Company is to keep the Articles of Incorporation consistent with current statutory provisions in regard to the limitation of monetary liability of the Company’s directors andnamed executive officers as allowed by Nevada State law.

Interest of Certain Persons in the Articles Amendment

No one who has been a Company director or executive officer since the beginning of our last fiscal year has any substantial interest, direct or indirect, by security holdings or otherwise, in the proposed Articles Amendment that is not shared by all other holders of the Company’s Common Stock.

PROPOSAL TO APPROVE RING ENERGY, INC. LONG TERM INCENTIVE PLAN

Description of Our Long Term Incentive Plan

The Ring Energy, Inc. Long Term Incentive Plan (the “Plan”) was in existence with Stanford Energy, Inc. (“Stanford”) and was adopted by the Board of Directors on June 27, 2012, and assumed by the Company upon the acquisition of Stanford. The following is a summary of the material terms of the Plan. A copy of the Plan is attached asAppendix B to this Information Statement.

Shares Available

Our Plan currently authorizes 2,500,000 shares of our common stock for issuance under the Plan. As indicated above, if the requisite shareholder approval is gained for the Plan Amendment, the Plan will authorize 5,000,000 shares of our common stock for issuance under the Plan. If any shares of Stock subject to an Award are forfeited or if any Award based on shares of Stock is otherwise terminated without issuance of such shares of Stock or other consideration in lieu of such shares of Stock, the shares of Stock subject to such Award shall to the extent of such forfeiture or termination, again be available for Awards under the Plan if no participant shall have received any benefits of ownership in respect thereof The shares to be delivered under the Plan shall be made available from (a) authorized but unissued shares of common stock, (b) common stock held in the treasury of the Corporation, or (c) previously issued shares of common stock reacquired by the Company, including shares purchased on the open market, in each situation as the Board of Directors or the Compensation Committee may determine from time to time at its sole option.

Administration

The Committee shall administer the Plan with respect to all eligible individuals or may delegate all or part of its duties under the Plan to a subcommittee or any executive officer of the Corporation, subject in each case to such conditions and limitations as the Board of Directors may establish. Under the Plan, “Committee” can be either the Board of Directors or a committee approved by the Board of Directors.

Eligibility

Awards may be granteddisclosed pursuant to the Plan only to persons who are eligible individuals at the timecompensation disclosure rules of the grant thereof or in connection with the severance or retirement of Eligible Individuals. Under the Plan, “Eligible Individuals” means (a) employees, (b) non-employee Directors and (c) any other person that the Committee designates as eligible for an Award (other than for Incentive Options) because the Person performs bona fide consulting orSEC. This advisory services for the Corporation or any of its Subsidiaries (other than services in connection with the offer or sale of securities in a capital raising transaction).

Stock Options

Under the Plan, the plan administrator is authorized to grant stock options. Stock options may be either designated as non-qualified stock options or incentive stock options. Incentive stock options, which are intended to meet the requirements of Section 422 of the Internal Revenue Code such that a participant can receive potentially favorable tax treatment, may only be granted to employees. Therefore, any stock option granted to consultants and non-employee directors are non-qualified stock options.

Options granted under the Plan become exercisable at such times as may be specified by the plan administrator. In general, options granted to participants become exercisable in five equal annual installments, subject to the optionee’s continued employment or service with our company. However, the aggregate value (determined as of the grant date) of the shares subject to incentive stock options that may become exercisable by a participant in any year may not exceed $100,000.

Each optionvote will be exercisable on such date or dates, during such period, and for such number of shares of Common Stock as shall be determined by the plan administrator on the day on which such stock option is granted and set forth in the option agreement with respect to such stock option; provided, however the maximum term of options granted under the Plan is ten years.

Restricted Stock

Under the Plan, the plan administrator is also authorized to make awards of restricted stock. Before the end of a restricted period and/or lapse of other restrictions established by the plan administrator, shares received as restricted stock will contain a legend restricting their transfer, and may be forfeited in the event of termination of employment or upon the failure to achieve other conditions set forth in the award agreement.

An award of restricted stock will be evidenced by a written agreement between us and the participant. The award agreement will specify the number of shares of Common Stock subject to the award, the nature and/or length of the restrictions, the conditions that will result in the automatic and complete forfeiture of the shares and the time and manner in which the restrictions will lapse, subject to the participant’s continued employment by us, and any other terms and conditions the plan administrator imposes consistent with the provisions of the Plan. Upon the lapse of the restrictions, any legends on the shares of common stock subject to the award will be re-issued to the participant without such legend.

The plan administrator may impose such restrictions or conditions, to the vesting of such shares as it, in its absolute discretion, deems appropriate. Prior to the vesting of a share of restricted stock granted under the Plan, no transfer of a participant’s rights to such share, whether voluntary or involuntary, by operation of law or otherwise, will vest the transferee with any interest, or right in, or with respect to, such share, but immediately upon any attempt to transfer such rights, such share, and all the rights related thereto, will be forfeited by the participant and the transfer will be of no force or effect; provided, however, that the plan administrator may, in its sole and absolute discretion, vest in the participant all or any portion of shares of restricted stock which would otherwise be forfeited.

Fair Market Value

Under the Plan, “Fair Market Value” means, for a particular day, the value determined in good faith by the plan administrator, which determination shall be conclusive for all purposes of the Plan. For purposes of valuing incentive options, the fair market value of stock: (i) shall be determined without regard to any restriction other than one that, by its terms, will never lapse; and (ii) will be determined as of the time the option with respect to such stock is granted.

Transferability Restrictions

Notwithstanding any limitation on a holder’s right to transfer an award, the plan administrator may (in its sole discretion) permit a holder to transfer an award, or may cause the Company to grant an award that otherwise would be granted to an eligible individual, in any of the following circumstances: (a) pursuant to a qualified domestic relations order, (b) to a trust established for the benefit of the eligible individual or one or more of the children, grandchildren or spouse of the eligible individual; (c) to a limited partnership or limited liability company in which all the interests are held by the eligible individual and that person’s children, grandchildren or spouse; or (d) to another person in circumstances that the plan administrator believes will result in the award continuing to provide an incentive for the eligible individual to remain in the service of the Company or its subsidiaries and apply his or her best efforts for the benefit of the Company or its subsidiaries. If the plan administrator determines to allow such transfers or issuances of awards, any holder or eligible individual desiring such transfers or issuances shall make application therefor in the manner and time that the plan administrator specifies and shall comply with such other requirements as the plan administrator may require to assure compliance with all applicable laws, including securities laws, and to assure fulfillment of the purposes of this Plan. The plan administrator shall not authorize any such transfer or issuanceapproved if it may not be made in compliance with all applicable federal and state securities laws. The granting of permission for such an issuance or transfer shall not obligatereceives the Company to register the shares of stock to be issued under the applicable award.

Termination and Amendments to the Plan

The Board of Directors may (insofar as permitted by law and applicable regulations), with respect to any shares which, at the time, are not subject to awards, suspend or discontinue the Plan or revise or amend it in any respect whatsoever, and may amend any provision of the Plan or any award agreement to make the Plan or the award agreement, or both, comply with Section 16(b) of the Exchange Act and the exemptions therefrom, the Internal Revenue Code, as amended (the “Code”), the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), the regulations promulgated under the Code or ERISA, or any other law, rule or regulation that may affect the Plan. The Board of Directors may also amend, modify, suspend or terminate the Plan for the purpose of meeting or addressing any changes in other legal requirements applicable to the Company or the Plan or for any other purpose permitted by law. The Plan may not be amended without the consentaffirmative vote of the holders of a majority of the sharesvotes cast by the holders of common stock then outstandingour Common Stock present in person or represented by proxy at the Annual Meeting and entitled to increase materiallyvote thereon. Broker non-votes and abstentions will not affect the aggregate numberoutcome of sharesthis proposal.

■Proposal 5 (Ratification of stock that may be issued under the Plan except for certain adjustments.

Federal Income Tax Consequences

The following is a summaryGrant Thornton):

Ratification of the United States federal income tax consequences that generally will arise with respect to awards granted underappointment of Grant Thornton LLP as our Plan. This summary is based on the federal income tax laws in effect as of the date of this Information Statement. In addition, this summary assumes that all awards are exempt from, or comply with, the rules under Section 409A of the Code regarding nonqualified deferred compensation. Changes to these laws could alter the tax consequences described below.

Incentive Stock Options

For federal income tax purposes as currently in effect, a participant will not have income upon the grant of an incentive stock option. Also, except as described below, a participant will not have income upon exercise of an incentive stock option if the participant has been employed by us or our 50% or more-owned corporate subsidiaries at all times beginning with the option grant date and ending three months before the date the participant exercises the option. If the participant has not been so employed during that time, then the participant will be taxed as described below under “Non-statutory Stock Options.” The exercise of an incentive stock option may subject the participant to the alternative minimum tax.

A participant will have income upon the sale of the stock acquired under an incentive stock option at a profit (if sales proceeds exceed the exercise price). The type of income will depend on when the participant sells the stock. If a participant sells the stock more than two years after the option was granted and more than one year after the option was exercised, then all of the profit will be long-term capital gain. If a participant sells the stock prior to satisfying these waiting periods, then the participant will have engaged in a disqualifying disposition and a portion of the profit will be ordinary income and a portion may be capital gain. This capital gain will be long-term if the participant has held the stock for more than one year and otherwise will be short-term. If a participant sells the stock at a loss (sales proceeds are less than the exercise price), then the loss will be a capital loss. This capital loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Non-statutory Stock Options

A participant will not have income upon the grant of a non-statutory stock option. A participant will have compensation income upon the exercise of a non-statutory stock option equal to the value of the stock on the day the participant exercised the option less the exercise price. Upon sale of the stock, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the day the option was exercised. This capital gain or loss will be long-term if the participant has held the stock for more than one year and otherwise will be short-term.

Restricted Stock Awards

A participant will not have income upon the grant of restricted stock unless an election under Section 83(b) of the Code is made within 30 days of the date of grant. If a timely Section 83(b) election is made, then a participant will have compensation income equal to the value of the stock less the purchase price. When the stock is sold, the participant will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the date of grant. If the participant does not make a Section 83(b) election, then when the stock vests the participant will have compensation income equal to the value of the stock on the vesting date less the purchase price. When the stock is sold, the participant will have capital gain or loss equal to the sales proceeds less the value of the stock on the vesting date. Any capital gain or loss will be long-term if the participant held the stock for more than one year and otherwise will be short-term.

Other Stock-Based Awards

The income tax consequences associated with any other stock-based award granted under our Plan will vary depending on the specific terms of such award. Among the relevant factors are whether or not the award has a readily ascertainable fair market value, whether or not the award is subject to forfeiture provisions or restrictions on transfer, the nature of the property to be received by the participant under the award and the participant’s holding period and tax basisindependent registered public accounting firm for the award or underlying common stock.

Tax Consequences tofiscal year ending December 31, 2023, requires the Company

There will be no income tax consequences to the Company except that we will be entitled to a deduction when a participant has compensation income. Any such deduction will be subject to the limitations of Section 162(m) of the Code.

PROPOSAL TO AMEND RING ENERGY, INC. LONG TERM INCENTIVE PLAN

General

On December 27, 2012, the Board of Directors, by unanimous written consent, approved an amendment to the Ring Energy, Inc. Long Term Incentive Plan (the “Plan”) to increase the total shares authorized under the Plan from 2,500,000 to 5,000,000. Under the Section 9.2 of the Plan, “The Plan may not be amended without the consentaffirmative vote of the holders of a majority of the votes cast by the holders of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Brokers will have discretionary authority to vote on Proposal 5 and, accordingly, there will be no broker non-votes for this proposal. Abstentions will not affect the outcome of this proposal.

HOW DOES THE BOARD RECOMMEND THAT I VOTE?

Our Board unanimously recommends a vote:

■FOR each of the nominees for director;

■FOR the Charter Amendment;

■FOR the Plan Amendment;

■FOR non-binding, advisory approval of named executive officer compensation; and

■FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

WHAT HAPPENS IF I PROVIDE MY SIGNED PROXY BUT DO NOT SPECIFY HOW I WANT MAY SHARES TO BE VOTED, OR IF ADDITIONAL PROPOSALS ARE PRESENTED AT THE ANNUAL MEETING?

If you provide us your signed proxy but do not specify how to vote, we will vote your shares as follows:

Proposal 1. FOR the election of each director nominee;

Proposal 2. FOR the Charter Amendment;

Proposal 3. FOR the Plan Amendment;

Proposal 4. FOR the approval, on an advisory basis, of the compensation of our named executive officers; and

Proposal 5. FOR the ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.

As of the date of this proxy statement, we do not expect any additional matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the proxy holder will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

WHO WILL BEAR THE COST OF SOLICITING VOTES FOR THE ANNUAL MEETING?

We will bear all expenses of soliciting proxies. We have engaged Broadridge Financial Solutions, Inc. to aid in the

distribution of proxy materials and to provide voting and tabulation services for the Annual Meeting. Directors, officers, and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with any solicitation. In addition, we may reimburse brokerage firms, custodians, nominees, fiduciaries, and other persons representing beneficial owners of our Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners.

MAY I PROPOSE ACTIONS FOR CONSIDERATION AT THE 2024 ANNUAL MEETING OF STOCKHOLDERS OR NOMINATE INDIVIDUALS TO SERVE AS DIRECTORS?

You may submit proposals for consideration at future stockholder meetings, including director nominations. Please read “Stockholder Proposals and Director Nominations for the 2024 Annual Meeting” for information regarding the submission of stockholder proposals and director nominations for consideration at next year’s annual meeting.

OUR 2022 PERFORMANCE HIGHLIGHTS

Our multi-faceted initiatives throughout 2022 significantly contributed to our financial performance for the year. Key highlights included:

| | | | | | | | |

| $138.6 MM | | $195.2 MM |

| Net income | | Adjusted EBITDA1 |

| | |

| $34.8 MM | | $197.0 MM |

Free Cash Flow1 | | Net Cash Provided by Operating Activities |

| | |

| 12,364 Boe/D | | $10.57 |

| Net Sales per day | | Lease Operating Expenses per BOE2 |

1A non-GAAP financial measure; see the end of this document for reconciliations to the most comparable GAAP financial measures.

2 Lease operating expenses divided by total barrels of oil equivalent sold during the same period.

Through our strategic efforts designed to drive financial stability and improve the balance sheet, we:

| | | | | | | | |

| | |

| Increased revenues by 77% from 2021 levels | Grew adjusted net income1 to $107.5 million – a 251% increase year-over-year | Successfully drilled and completed 32 wells |

| | | | | |

| |

Generated free cash flow1 of $34.8 million (including generating free cash flow every quarter during 2022) | Paid down $37 million of borrowings on bank credit facility, since the closing of the Stronghold Acquisition on August 31, 2022 |

We ended 2022 with an increase in proved reserves to 138.1 million barrels of oil equivalent (“MMBoe”) from 77.8 MMBoe at year-end 12/31/2021:

■Additions, improved well performance and technical revisions led to net upward revisions of 64.8 MMBoe;

■Reduced for production of 4.5 MMBoe.

1 A non-GAAP financial measure; see the end of this document for a reconciliation to the most comparable GAAP financial measure.

OUR COMMITMENT TO ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”)

We are focused on creating long-term value for our stockholders and fostering a culture that is steadfast on environmental sustainability, operational safety, social responsibility and sound corporate governance.

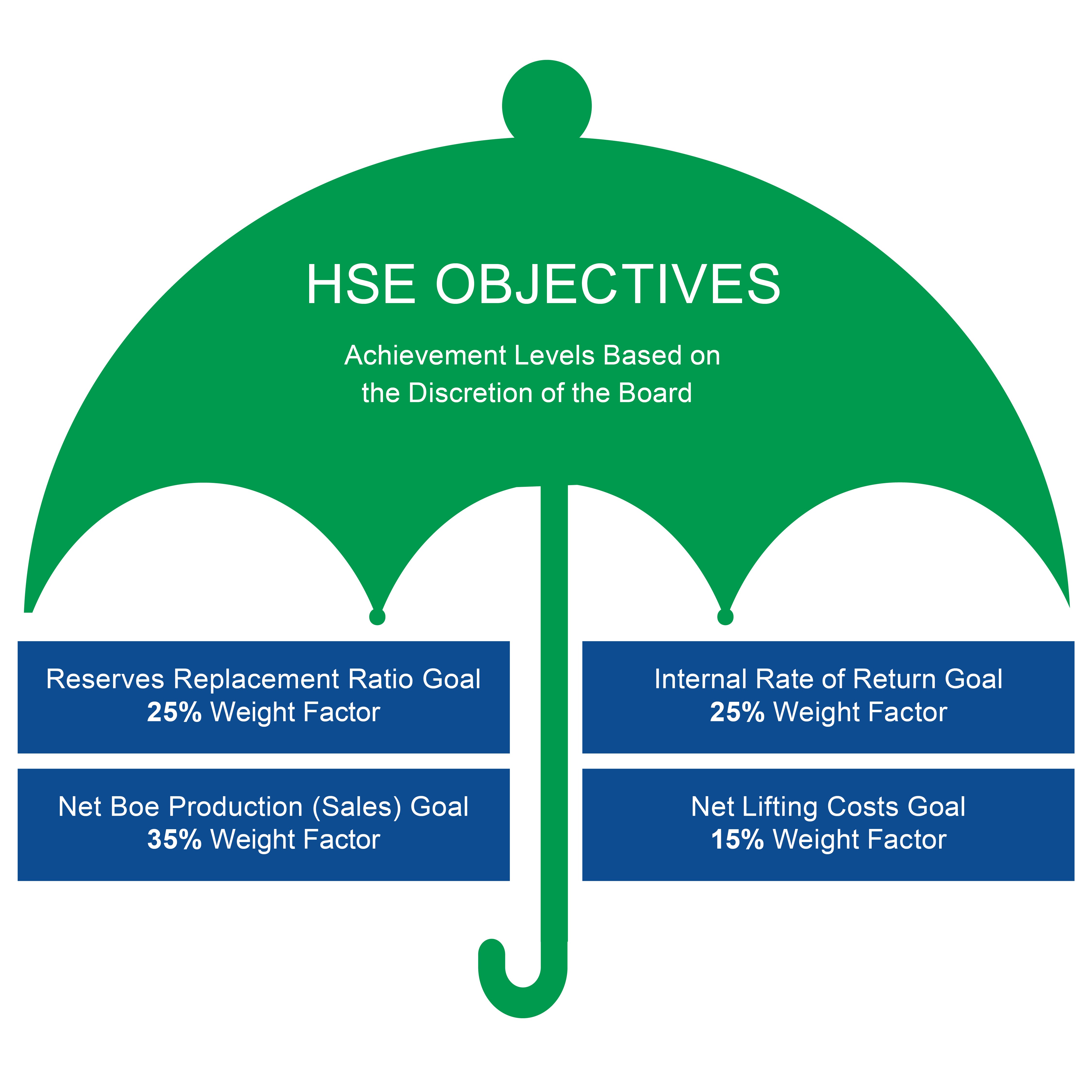

In 2021, we created an ESG Task Force that is comprised of management representatives from Health, Safety & Environmental (“HSE”), Operations, Legal, Human Resources, Investor Relations and Finance. The task force is charged with the responsibility to monitor the Company’s adherence to our ESG standards and formally communicate their findings on an ongoing basis to our CEO and the Board. We published our detailed inaugural ESG report in 2021 and published a follow-up report in 2022. Included in our reports is a discussion of our steadfast efforts to disclose our ESG performance record, as applicable, and discuss our plans to drive further alignment in the future with the various reporting frameworks as we continue our ESG reporting journey.

In the creation of our ESG reports to date, we have consulted the Sustainability Accounting Standards Board’s (“SASB”) Oil and Gas Exploration and Production Sustainability Accounting Standard, the recommendations of the Task Force on Climate- related Financial Disclosures (“TCFD”), the Sustainable Development Goals (“SDGs”) promulgated by the United Nations, and other reporting guidance from industry frameworks and standards.

| | | | | |

| ENVIRONMENTAL We are committed to protecting and preserving the environment in all aspects of our business, including production operations, well work programs, and decommissioning activities. Our policies and procedures are designed to meet or exceed adherence with all federal, state and local regulations, and we expect our contractors to have similar programs in place. Our efforts to minimize our operational impact are multi-faceted, including reducing greenhouse gas (“GHG”) and air emissions, minimizing the use of freshwater, preventing spills, safeguarding local water supplies and minimizing waste. Our ongoing environmental programs are designed to not only reduce our operational impacts but also improve efficiency, lower costs and reduce risk, which promotes the long-term sustainability of our business, while enhancing our relationships with the communities in which we operate. |

| | | | | |

| SOCIAL We strive to attract, develop and retain a highly qualified workforce in the industry as we recognize our future success is a direct result of their efforts. As such, we provide a competitive compensation and comprehensive benefits program, as well as a positive work environment designed to drive a culture of safety and innovation. We are also committed to continuously providing an inclusive, safe and secure work environment where all of our employees can be respected, valued, and successful in pursuing their goals, all while contributing to the Company’s success. We will continue to promote honesty and integrity in all interactions with our employees and actively support the communities in which we operate with both our time and resources. We recognize and appreciate the ongoing efforts of our employees in their personal commitments from both a time and financial perspective in enhancing the quality of life in our local communities. As of December 31, 2022, we had 98 full-time employees as well as a diverse group of independent contractors who assist our full-time staff in a range of areas including geology, engineering, land, accounting, and field operations, as needed. None are represented by labor unions or covered by any collective bargaining agreements.

|

Diversity and Inclusion The unique backgrounds and experiences of our employees help to develop a wide range of perspectives that lead to better solutions. Our staff’s diversity is reflected in our full-time employees where 24% are women and approximately 49% represent minorities, as of December 31, 2022. The majority of our employees are citizens of the United States, with a few retaining dual citizenships in other countries. The employees who are not U.S. citizens are legally registered to live and work here and the Company is committed to helping those employees retain their ability to remain in the U.S. and continue their employment. |

| GOVERNANCE We leverage sound corporate governance practices that promote accountability and good decision making, which is a key tenet to our long-term success and sustainability. Our Board and its committees are responsible for our strategy and governance and these practices depend on our guiding principle to conduct our business in accordance with appropriate legal and ethical standards, and with honesty and integrity. We expect all employees across the organization to exemplify these principles as they conduct their work activities and appreciate their collective efforts in this regard. |

BOARD COMPOSITION AND EXPERIENCE

| | | | | |

8 MEN 1 WOMAN DIVERSITY BY GENDER | |

| |

7 INDEPENDENT 2 NOT INDEPENDENT DIVERSITY BY INDEPENDENCE | |

| |

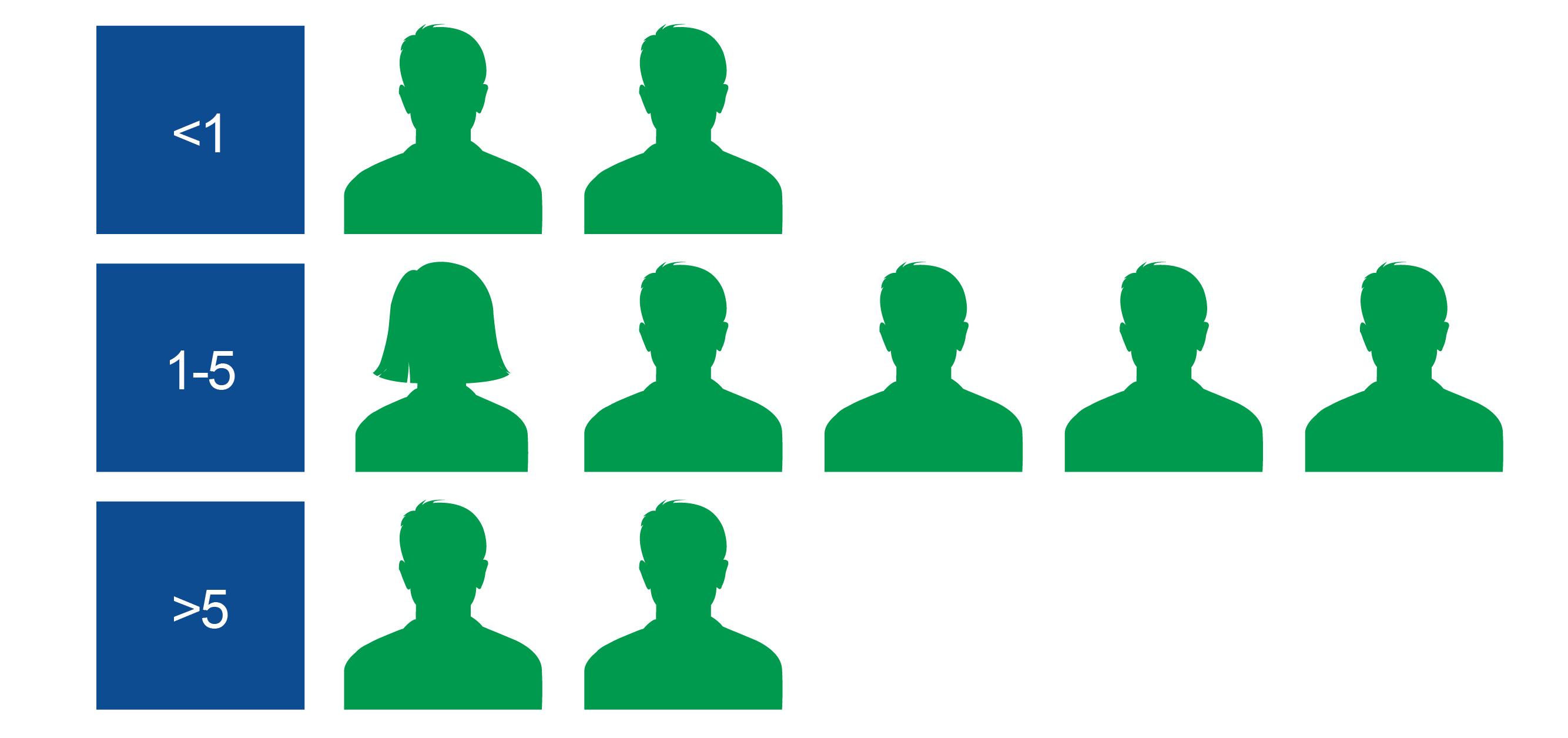

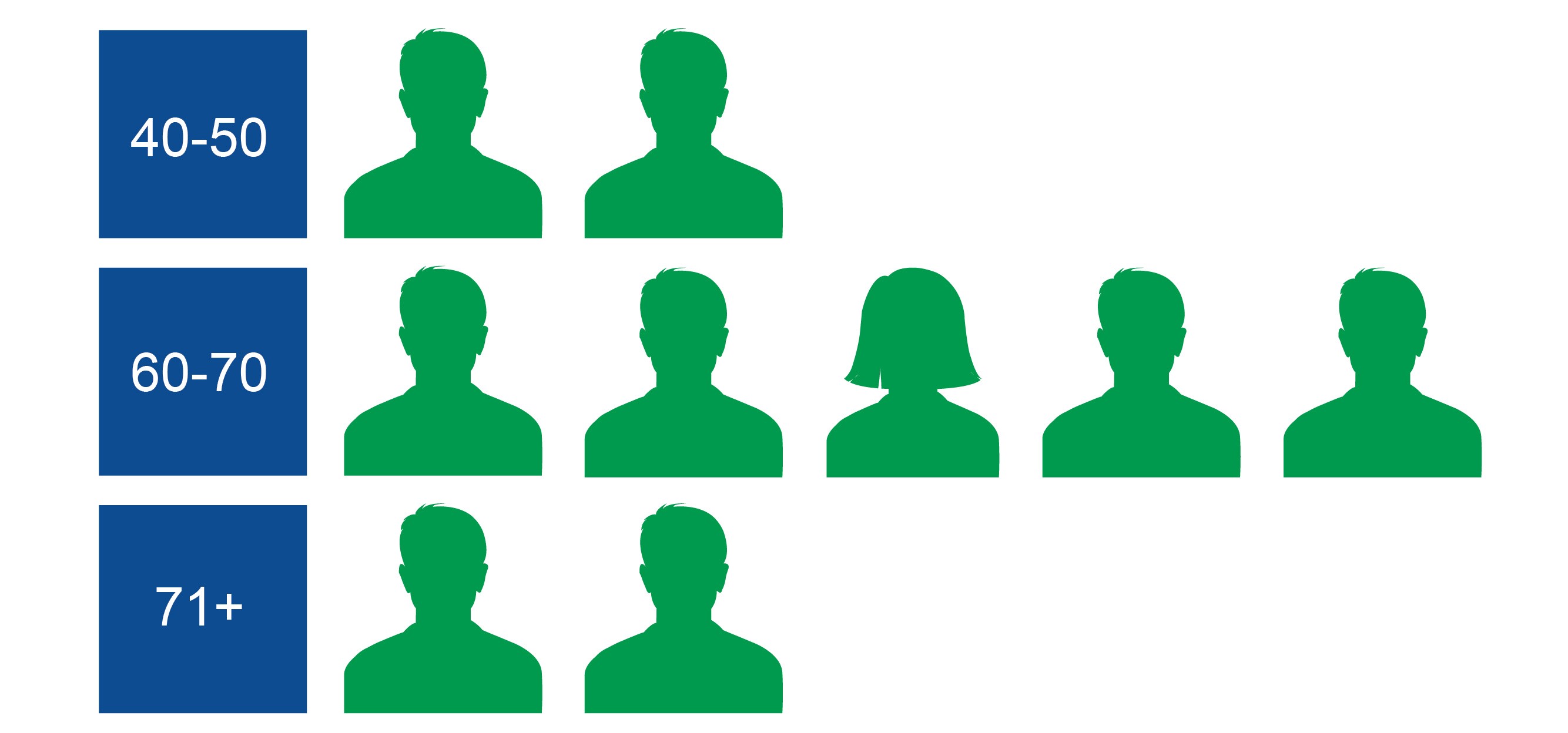

DIVERSITY BY TENURE Years | |

| |

DIVERSITY BY AGE Average Age: 63 | |

PROPOSAL 1:

ELECTION OF DIRECTORS

At the Annual Meeting, the stockholders will elect nine directors to serve on our Board until the 2024 annual meeting or until their successors are duly elected and qualified. Upon the recommendation of the Nominating, Environmental, Social, and Governance (“NESG”) Committee of the Board, our Board has nominated as directors the following nine individuals, each of whom is presently serving as a director.

DIRECTORS

The following table sets forth the names, ages, and titles, as of April [ ], 2023, of each of our directors:

| | | | | | | | |

| NAME | AGE | POSITION |

| Management Directors |

| Paul D. McKinney | 64 | Chairman of the Board of Directors and Chief Executive Officer |

| Non-Independent Directors |

| Roy I. Ben-Dor | 40 | Director |

| Independent Directors |

| Anthony B. Petrelli | 70 | Lead Director |

| John A. Crum | 71 | Director |

| David S. Habachy | 47 | Director |

| Richard E. Harris | 70 | Director |

| Thomas L. Mitchell | 63 | Director |

| Regina Roesener | 63 | Director |

| Clayton E. Woodrum | 83 | Director |

We did not pay any third-party fees to assist in the process of identifying or evaluating candidates. Each nominee is currently a director on our Board. Messrs. Woodrum and Petrelli joined the Board in January 2013. Ms. Roesener joined the Board in September 2019. Messrs. McKinney, Mitchell, Crum and Harris joined the Board in October 2020. Messrs. Ben-Dor and Habachy joined the Board in September 2022.